Why Configuring Sales Tax for Your Rental Business Is Crucial: A Guide to Compliance and Accurate Invoicing

As a rental business owner, you have a whole host responsibilities to manage. From maintaining inventory to handling customer service, it can often feel overwhelming. However, one task you can’t afford to overlook is configuring sales tax correctly for your business. Whether you run an online store, a physical shop, or offer services, understanding and applying sales tax is not only a legal requirement but also a key component in providing a smooth, professional experience for your customers. And Any.Rentals is here to help!

In this post, we’ll explore why configuring sales tax is crucial for your business, how it ensures compliance, and how our rental software can simplify the process for you.

The Importance of Sales Tax Configuration

Sales tax varies significantly depending on where your business is located, where your customers are located, and the type of product or service you’re selling. With constantly changing tax laws and regulations at the local, state, and even federal levels, it can be challenging to ensure that you’re applying the correct tax rates every time.

If sales tax is not configured accurately, businesses can face serious consequences, including:

- Penalties and fines for failing to collect or remit the right amount of sales tax

- Overcharging customers, which can damage your brand’s reputation

- Undercharging, leaving you responsible for paying the difference out of pocket

Proper configuration not only protects your business but also ensures that your customers receive accurate invoices. Everybody’s happy!

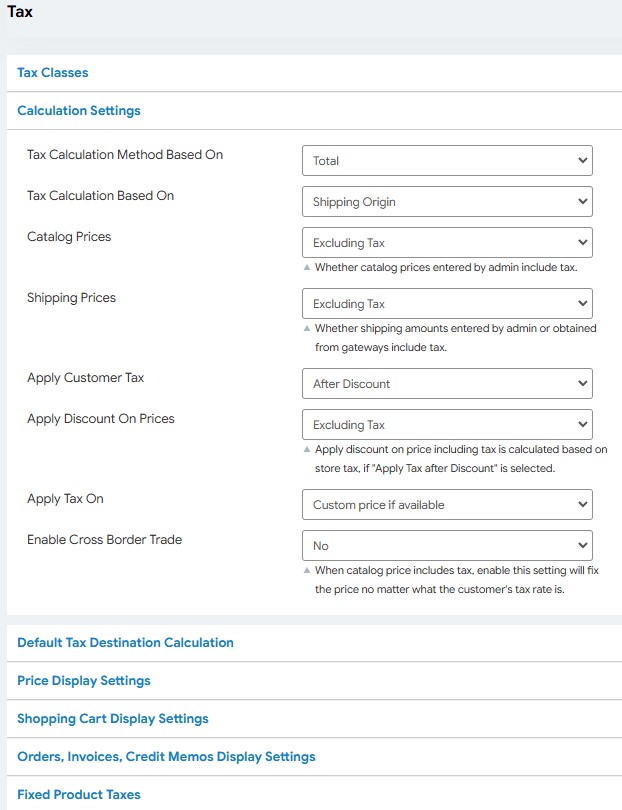

How Our Rental Software Helps You Configure Sales Tax

With so many complexities surrounding tax laws, manually calculating sales tax for each transaction is time-consuming and prone to error. This is where our rental software comes into play. Designed with rental businesses in mind, our software automatically configures accurate sales tax based on several important factors:

- Location: Sales tax rates vary from one place to another, even down to the city or county level. Our software identifies the correct tax rate for your business location as well as the customer’s location, ensuring that the right rate is applied.

- Customer Base: Whether you’re dealing with tax-exempt customers or regular consumers, our software can distinguish between these groups, applying appropriate rates based on their status.

- Product Type: Some products may be exempt from sales tax, while others may be taxed at a different rate depending on your region. Our rental software takes into account the type of product being rented or sold, making sure that the right tax is applied based on the local tax code.

Ensuring Compliance and Accuracy

Compliance with tax regulations is crucial for avoiding audits, penalties, and even potential legal trouble. Nobody wants any of that. By automating your sales tax configuration, you not only ensure accuracy but also stay compliant with constantly changing tax laws.

Our software is designed to stay up-to-date with the latest tax rate changes, so you never have to worry about manually updating tax rates when new legislation passes. Whether you’re renting out products, offering services, or selling goods, you can trust our system to apply the right amount of sales tax automatically at checkout.

Providing Clear and Accurate Invoices for Your Customers

Accurate invoicing is vital for maintaining transparency and building trust with your customers. When you use our software to configure sales tax, customers will see a clear breakdown of what they’re being charged, including the tax amount. This not only ensures they are not overcharged but also helps them understand the cost structure of their purchases, leading to a better overall customer experience.

Why This Matters:

- Customer Trust: Transparent, accurate invoices create trust. When customers know they are being charged correctly, they are more likely to return and recommend your business to others.

- Efficiency: Automating sales tax saves you time, which means you can focus on growing your business rather than dealing with complex tax calculations.

- Peace of Mind: Knowing that your taxes are configured correctly allows you to focus on what really matters: delivering great products and services to your customers.

Stay Ahead of the Curve….and Uncle Sam

Sales tax regulations are constantly evolving, and it’s important for businesses to stay ahead of these changes to avoid mistakes. By configuring sales tax correctly from the start, you are setting your business up for long-term success. With our rental software, you can feel confident that taxes will be applied correctly, your invoicing will be accurate, and your business will remain compliant with local and state regulations.

Configuring sales tax for your rental business is not just about avoiding penalties—it’s about offering a smooth, professional experience for your customers. With the right tools, such as Any.Rentals, this process becomes easy, efficient, and error-free. Invest the time to configure your sales tax correctly now, and it will pay off in the form of improved compliance, accurate billing, and greater customer satisfaction.

Book a demo today to learn more!